If anyone fears a government crisis, it is this: When the ship heads to the rocks, what does it matter who is at the helm? With a debt out of control, waiting for reforms (justice, school, health, infrastructure, taxes, etc.)

If anyone fears inflation, here it is: Leading economic indicators now in a recessive phase, the European Central Bank increasing the discount rate by 50 basis points and the Fed without limits in raising interest rates in a credit crunch not seen in decades.

If no one is happy with these two global streaks, it is China setting the time, the war in Ukraine, and fears of shutting down the gas tap that keeps us alive.

The economy is a body in flux, and if you’re not waiting for the next step focused on what’s happening now, you’re done because the data we see is always behind.

So in a context like this, you understand that the exchanges are catching their breath because perhaps, as always, it’s all over.

If you scroll through the individual charts of the Italian Stock Exchange and Nasdaq, you will realize that after 6 months of vacation, we have to get back to work. There are many stocks that are one step away from buying and they are stocks (of all I remember Ferrari, rather than Brunello Cucinelli, Ferragamo or El.En) that found support for the previous relative maximum, as written in technical analysis handbooks.

A sign that this may be the bottom line for stock markets for a long time, given that if the headlines are indeed the arrival of the crisis, the crisis is already underway or has already ended.

These are the moments when the storm has passed and the bounty hunters come out of the woods.

Their logic is simple: if stocks have lost 35% from the highs and we are probably at the bottom, why not go and pick the stocks that have the best fundamentals or in any case the least risky and in any case make the investor happy a return of close to 10%? Yes, because at these prices it is easy to find stocks that make almost +10% on the Milan List and that’s just for profits. And since the EPS is given by dividend plus stock appreciation if I really start with +10% against a 10 year BTP that yields 3.25%, would you want to imagine that in 3 years I will lose money?

The logic is impeccable and the only resource our investors need is patience and perhaps we will understand if the downturn is already over or not and should continue to another 35%.

But we all know that financial markets mean back and after the bad comes the good and after the good comes the bad. Since the bad has already come, what will come next? beauty! This is the logic of the profit hunter in its brutal simplicity.

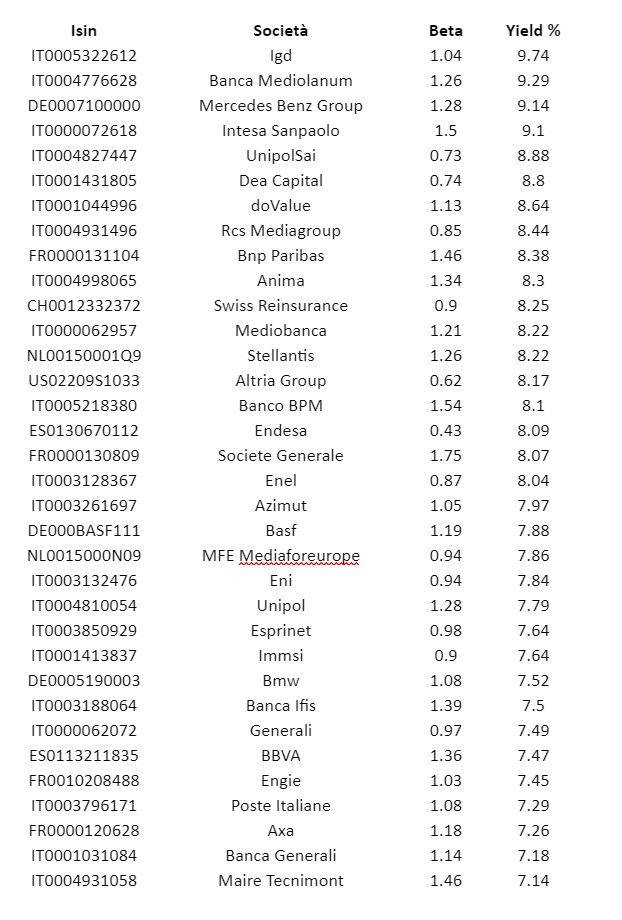

Below is a list of the best companies listed on the Italian Stock Exchange in terms of dividend yield or, from a very family perspective, the yield generated by dividends divided by the stock price so far. It is a dividend that is either distributed in 2022 or approved in any case in 2022.

Dividends are known to be “fixed”, or rather, management tries not to reduce them so as not to transmit negative signals to the market, while it can slowly increase over time. Based on this statistical evidence, our dividend hunter knows that if Intesa San Paolo does not distribute the same dividend in 2023, it will be the end of the world in the markets. And he trusts this.

Here is the list of last Friday’s prices:

We have also published beta which is a risk indicator that tells us whether a stock is moving more than the market index (greater than 1) or less than the market index (less than 1). And if we scroll through the list that combines return and risk at a glance, we can come to unexpected conclusions, without compromising the premise that profits are really necessary (but we saw that the odds were in our favor).

For example, we can ask ourselves if it is really worth investing in Intesa San Paolo taking a 9.1 return with a beta 1.5 risk rather than going home with Banca Mediolanum for 9.26 taking a beta 1.26 risk.

The question seems completely silly and impossible to answer. But if in fact, by downloading the data from any basic analysis platform, we make the relationship between the dividend yield and the beta, we get a completely different view of the market that greatly helps us in our decision:

At this point in the ranking column, you can see that if we order it from highest to lowest (i.e. the return is a multiple of risk), we find that the cheapest Italian stake is Unipol SAI because the return in absolute terms is probably lower than that of Intesa. But for the beta risk we pay to buy it, it’s really cheap.

RCS and Enel stocks follow in descending order while our Intesa San Paolo sank among the latest comfort ratios.

This is why knowing where to put your hands inside an excel sheet like this allows you to choose the best without being deceived by what your financial analysts say.

Making the decision on your own is the best solution because only in this case do you know how to consciously weigh the risks and returns. A few minutes a week is enough, a professional platform is enough for a few hundred euros and the game is over.

In my free webinar next Wednesday, July 27th at 5.30pm, I will try to explain this concept better by showing examples of selection in stocks, mutual funds, and bonds.

To register for free and without obligation to the webinar, click here >>

Regarding the last table with the order of the ratio between dividend yield and risk, we note one thing: the Endesa ratio is 18 while the San Paulo ratio is 6, so the ratio ratio (no pun) is three times in favor of Endesa. In other words, buying an Endesa is worth three times as much as buying an Endesa.

This result, which may sound absurd but the numbers speak for themselves, would not have been achieved if we had not built a return/risk table in 2 seconds.

We’re not saying that readers should throw themselves headlong into buying Endesa and selling San Paolo Invest. We say rankings of financial stocks helps with asking the right questions. If we don’t ask ourselves the right questions, we won’t be able to give ourselves the right answers. This is the message that needs to be communicated to the reader and this is what we will talk about in our free webinar.

Leave a Reply