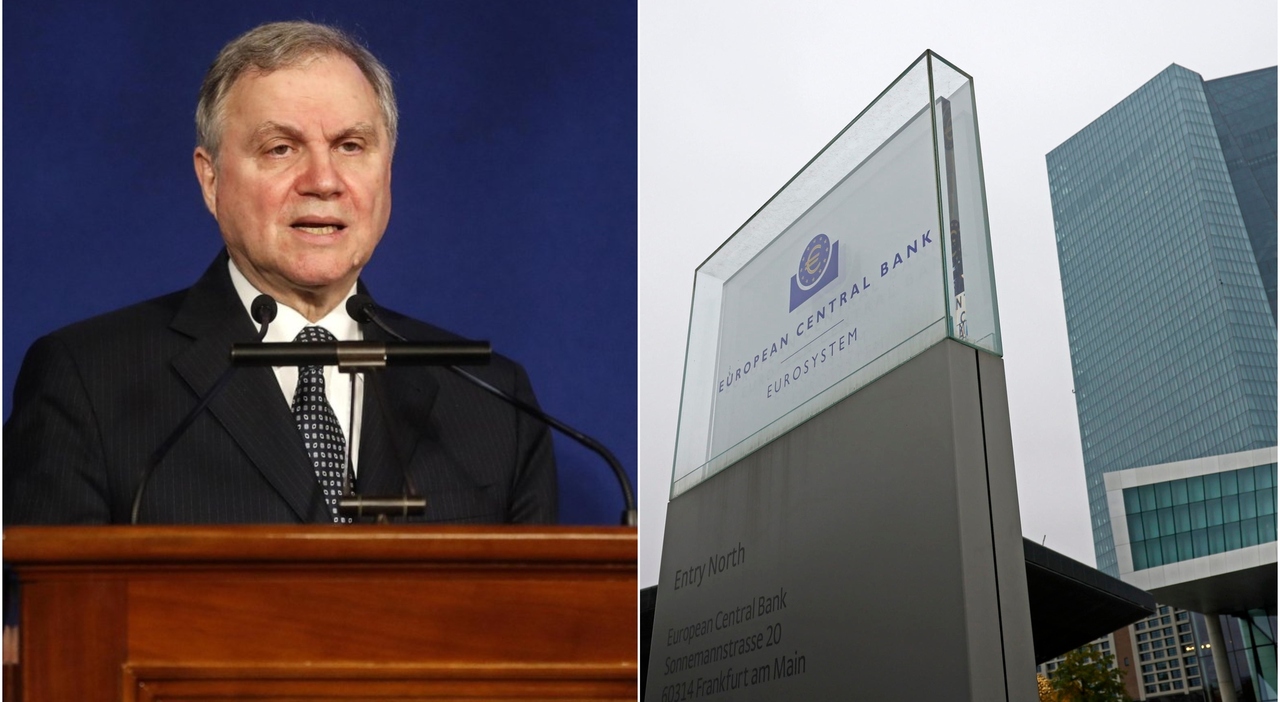

there European Central Bank Should not follow “blindly” Federal Reserve American in Maxi heights interest rates. Continuing on this path in the coming months is a “fatal mistake”. This was stated by the governor Bank of Italy And a member of the board of directors European Central BankAnd the Ignazio Visco Speaking in Florence at the Cesifin Conference. For the first time, Visco is clearly and openly siding with the path of draconian cost-of-money increases set by the central bank led by Christine Lagarde. Until now, on every eve of decision-making in Frankfurt, hawkish voices always prevailed. Like the German Isabelle Schnabel, who was sent by Lagarde to the American symposium in Jackson Hole to announce significant increases in European interest rates. Visco usually plays the role of a dove, but this time he exposed the claws of the hawk “against”.

Visco: “The price hike has gone up a lot, and we’ve gone into a recession. Serious mistake in the wake of the Fed”

Today, he explained, “I see no obvious reason to tie our hands to hypotheses of extraordinarily high increments such as those read in some parts.” Between the lines of the Governor’s intervention, it is suggested that the much discussed “neutral rate”, that is, that which is neither restrictive nor extended, has already been reached. According to the latest estimates, it specifies that this level of interest rates will be between 0.7 and 1.8 percent. Since the interventions in July (0.50 point increase) and September (0.75 point increase), the ECB rate has already been raised to 1.25 percent, meaning that the neutral rate “could have already been reached by the ECB” or It might be ‘close to that soon’.

To what extent, then, can prices be raised? It’s hard to say, but it’s better to be careful. Visco once again clarified that higher rates could not affect the energy shock. Prices are rising in Europe and Italy because gas and electricity are costing so much because of the war in Ukraine. But monetary tightening has no effect on this trend: even if rates rise significantly, the cost of gas and electricity will not fall.

steps

But there is also a second point. The effect of a rate hike on inflation appears after a year or two. Above all, it began to affect economic growth after a year and a half. What does this mean? Higher interest rates can have an effect when the economy has already slowed. In short, it can “lead or amplify a stagnation”. Pursuing the Fed, according to the governor of the Bank of Italy, “also makes no sense for another reason”: the American and European situation are completely different. The United States has spent far more than Europe to tackle the pandemic. US debt grew 25 percent to more than 130 percent. The European level is up 15 per cent but is stuck, on average, at 95 per cent. American families have gone through a paradox during the pandemic. Their economy declined by 3.4 percent, but their income rose by 6.2 percent. In Europe, households suffered a 0.6 percent drop in their earnings during the pandemic. In America, there are two jobs available to every unemployed person. In Europe, there is less than one place available for every unemployed person.

The differences

Inflation in the United States is mainly caused by increased demand, made up of many people working with increasing incomes. In Europe, the price hike depends mostly on the sharp rise in energy. In the eurozone, gas prices rose 150% to more than 200 euros per megawatt-hour. In the US, despite a 50 percent increase, gas still costs less than $30 per megawatt-hour. Not only. However, inflation does not appear to be out of control in Europe at the moment. Of course, the dynamic will remain tense in the coming months. But it will actually fall to around 5 per cent in mid-2023, then drop quickly and consistently to levels close to the European Central Bank’s 2 per cent target. Therefore, the governor explained that “excessive progress in normalizing official rates”, “may be disproportionate.”

Moreover, for Visco, accusations against the European Central Bank of delaying the course of monetary policy normalization are “unjustified”. Those who point to the index should also remember that expansionary policies with unconventional tools, such as sub-zero rates and quantitative easing, have allowed the European economy to face serious crises by driving economic growth. A lesson that many seem to have already forgotten.

© Reproduction reserved

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”