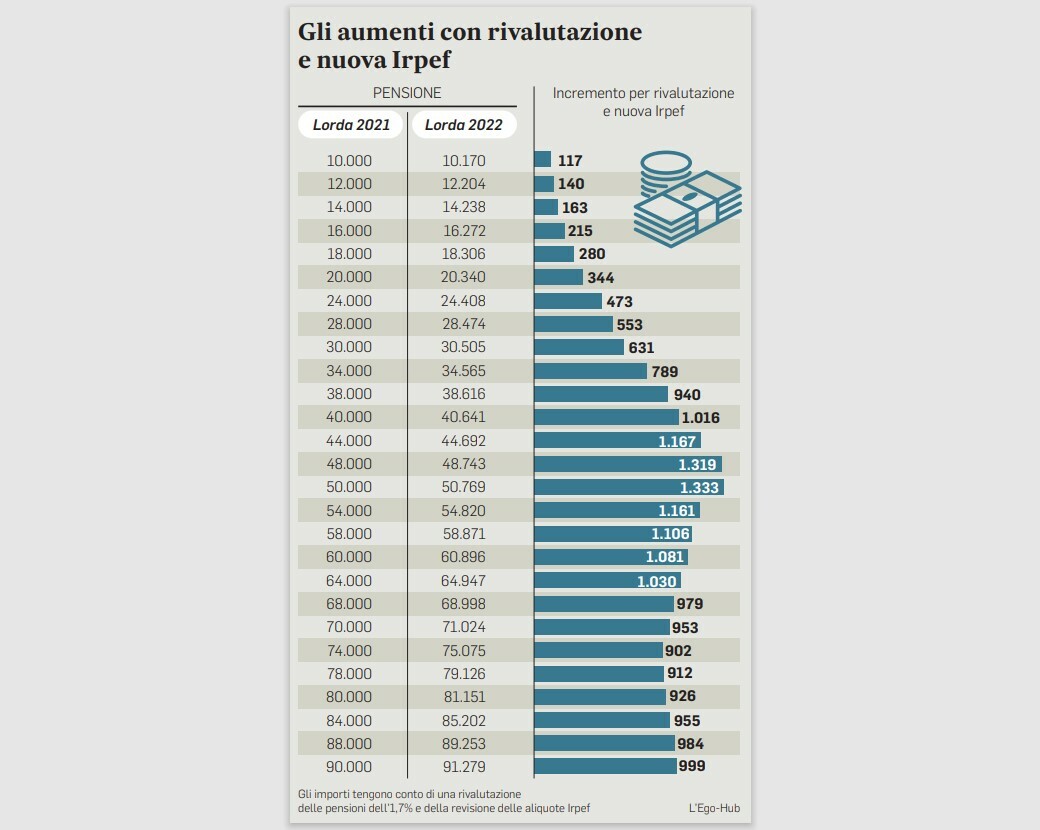

annuities Higher in 2022. After last year’s hiatus, revaluation checks are back. Moreover, with the reduction of incoming income tax, transactions above 15 thousand euros in total per year will see another increase. With the largest expected benefits to income around 50 thousand euros in total per year. Reviewing deductions for all categories of taxpayers — but the details have not yet been determined — will increase the exemption threshold for pensioners who are not entitled to lower taxes. So far, the cap has been set at €8,130 and is expected to rise to €8,500.

Reducing taxes on low incomes by more than a thousand euros

Annuities, decree

The decision of the Ministry of Economy, in agreement with the Labor Department, regarding the rate of reassessment of pension allocations, was issued last November 26 in the Official Gazette. Because of the sharp rise in inflation in recent months, the value was set at 1.7%, after pensions in 2021 were not adjusted to fit the rising cost of living, given that the previous year’s prices were characterized by a negative trend. It is also possible that the temporary revaluation ratio, which was determined on the basis of the first nine months of this year, may be slightly lower than the actual ratio, given the gradual growth of inflation recorded in recent months. The lost stake will be recovered in any case in 2023.

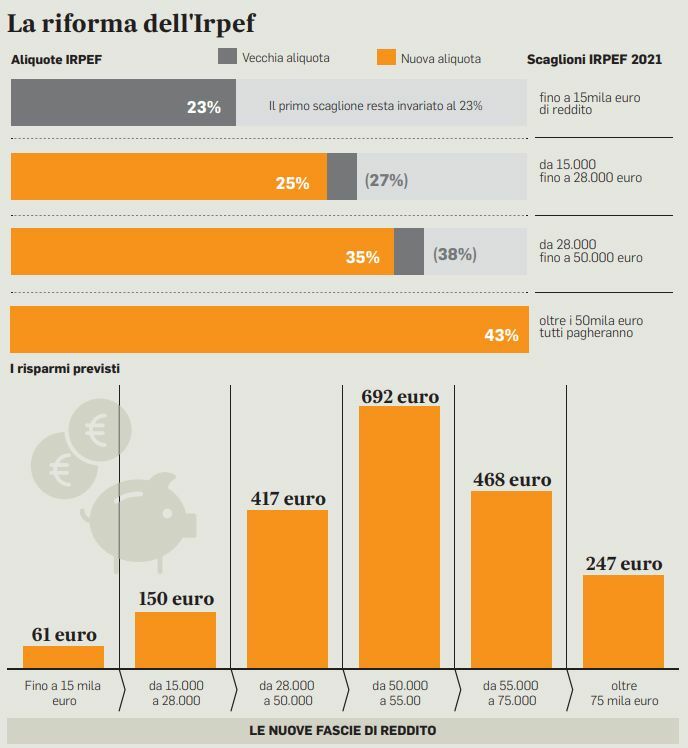

However, this time around, the pension equation (as technically defined by the revaluation) will be able to take advantage of a more advantageous calculation mechanism in recent years: the increase will in fact be applied entirely to the pension scale up to 4 times the minimum INPS (€26,680 per gross year), 90 per cent in the range 4-5 times and 75% more than 5 times (ie more than €33,475 gross per year). The cost of the modification is estimated at 4.7 billion. In 2022, pensions, which INPS will recalculate before the end of the year, will benefit from the tax cut that the government is preparing to launch and has not yet been determined in all the details. Based on the agreements in the majority, which unions have so far disputed because they favor higher incomes, the new rates should change as follows: the first (up to 15,000 euros in total) remains unchanged at 23 per cent. And 27 percent, which ranges from 15,000 to 28,000 euros, goes down to 25, the subsequent 38 percent goes down to 35 and applies up to 50,000 euros, after which the withdrawal is activated by 43 percent (the 41 percent rate is canceled).

profit

Thus, the advantage of a lower tax burden, which varies with income, will be added to the pension reassessment. Profits will grow gradually, peaking at around 50,000 euros of income, and then declining again. Up to 15 thousand there are only traces of revaluation (about 200 euros maximum). With a gross pension increase of up to 20 thousand euros per year, the increase amounts to 344 euros, while at 40 thousand euros the increase is 1016 euros. Then it grows again taking advantage of lower tax rates and reaches around €1,330 for a total income of around €50,000. The interest accrued for the tax reduction is then reduced to a fixed amount of €270, while the revaluation varies significantly according to the amount of the pension.

In the table average expected savings for income from work or retirement with income tax reduction (check revaluation is not taken into account)

© Reproduction reserved

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”