Five years after the entry into force of Ceta, the free trade agreement between the European Union and Canada, here is data on Italian trade for Ottawa, as reported by the Sace Research Office.

On September 21, 2021, CETA, the free trade agreement between the European Union and Canada, entered into force in a provisional form: it has not yet been ratified by the parliaments of all European member states, including Italy.

CETA – short for the Comprehensive Economic and Trade Agreement – virtually eliminates tariffs between the EU and Canada, as well as provisions to facilitate investments and allow mutual participation of companies in public tenders.

The opposition of Salvini and Di Maio

CETA was strongly opposed in Italy by the Coldretti (farmers’ union) and the 5 Star movement and Lega. In 2018 Luigi Di Maio, then Minister of Labor and Economic Development He defined He said it was a “bad deal” and that Italian officials abroad who supported the deal would be removed from their posts.

On the other hand, then Interior Minister Matteo Salvini declared that CETA was “legitimizing”.Italian sound, a counterfeit of Italian goods. Opening up the market Parmesan and at Mozzarella“, that is, foreign food products with names like Italian originals to deceive consumers. In fact, it was explained at the time Political report card“The agreement, introduced for the first time, aims to strengthen the protection of typical Italian products and their brands in trade relations between the European Union and Canada. […] Thanks to the recognition and commercial protection in Canadian territory of 143 European Geographical Indications (IIGG), 41 of which are Italian “.

Trademarks of origin protected by CETA include, for example, Parma, San Daniele, Toscano and Modena hams and cheeses such as Parmigiano Reggiano, Asiago, Fontina, Gorgonzola and Buffalo mozzarella.

How are Italian exports to Canada faring?

On the occasion of the fifth anniversary of the entry into force of CETA, Mr SACE – the Export Credit Insurance Agency controlled by the Ministry of Economy – released a series of data on the trend of trade between Italy and Canada.

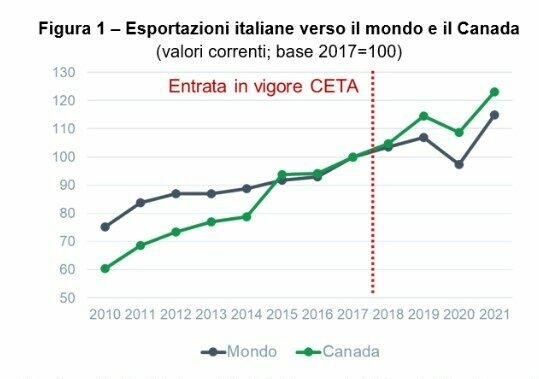

CETA, SACE writes, has allowed “further improvement” of trade relations between Rome and Ottawa. In 2021, Italian exports to Canada will reach 4.8 billion euros. Between 2017 and last year they grew at an annual average of 5.5 percent, one percent higher than the average of Italian exports to the world.

During the same period, Canada became the tenth non-EU destination for Italian products, gaining four places. Italy’s market share in the country rose from 1.03 to 1.16.

Provisional data for 2022: +28.8 percent

In the first half of 2021, Italian exports to Canada increased by 28.8 percent compared to the same period in 2021.

Preferential rule

SACE talks about the “good effects of CETA” also due to the preferential PUR (preferential utilization ratio) regime: it represents – the company explains – “the share of goods actually exported (imported) under the CETA regime in the total exports (imports). Who is entitled to benefit from it?” .

The reduction of duties is not really automatic, but is subject to compliance with certain requirements, such as rules of preferential origin, which define the conditions under which a product can be produced in a country and special exchange agreements can be made.

Import and export

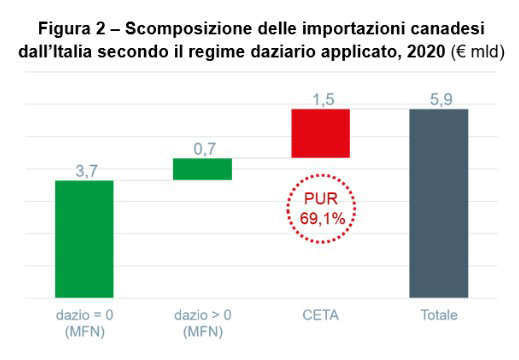

In 2020, the latest year for which data is available, Italy imported 3.7 billion euros worth of goods from Canada. About 60 percent of these are not subject to duties, requiring a Most Favored Nation (MFN) rule; The rest, on the other hand, fall under CETA’s preferential regime.

In 2020, Italian exports that re-entered the CETA regime amounted to 1.5 billion. PUR was 69.1 percent, higher than European production (55.2 percent) and higher compared to previous years.

Food, ceramic tiles, and stone glassware comprise more than 80 percent of the items. On the other hand, PUR is lower, around 65 percent, for various sectors such as textiles, clothing, footwear and transportation equipment.

“This may reflect for relatively well-monitored supply chains such as food”, SACE explains, “proving priority origin is less burdensome; on the contrary, for more fragmented supply chains characterized by a high incidence of imported production inputs, meeting the requirements may be more complex”.

Investments

Italian direct investments in Canada increased from 2018 to 2021, with an annual average of 500 million euros compared to 153 million in the 2014-2017 period.

SACE writes that Italian and European companies can take advantage of Canadian infrastructure projects – especially in the province of Quebec, from $142.5 billion by 2032 – to reap benefits for their businesses.

Sign up for our newsletter

Subscribe to our mailing list to receive our newsletter

“Total coffee junkie. Tv ninja. Unapologetic problem solver. Beer expert.”